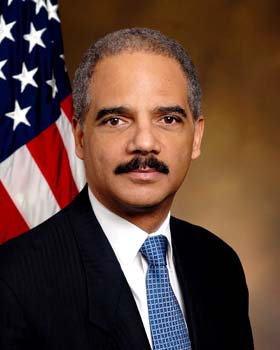

Holder said virtual currencies can "pose challenges for law enforcement given the appeal that they have among those seeking to conceal illegal activity."

Law enforcement authorities across the planet are concerned with the use and abuse of virtual currencies where users can remain anonymous by using pseudonyms and transact through trusted third parties and finance exchanges.

Holder said the Department of Justice "is committed to innovating alongside this new technology in order to ensure investigations are not impeded by any improvement in criminals' ability to move funds anonymously."

Bitcoin was founded in 2008, and since then has become ubiquitous with merchants who sell legitimate products as well as those who deal in drugs, firearms or other illegitimate products. Virtual currency payments make it extremely difficult to track the purchaser from the financial transactions data.

Holder emphasized to the House Judiciary Committee that "As virtual currency systems develop, it will be imperative to law enforcement interests that those systems comply with applicable anti-money laundering statutes and know-your-customer controls."

The virtual currency scene continues to get murkier with many nations not having adequate laws in place to regulate transactions done with virtual currency, but also unable to ignore their impact and legality. Bitcoin is also giving a headache to the IRS after it ruled this year that it will be treating Bitcoin as property for tax purposes and would apply the rules used to govern stocks and barter transactions to transactions made with Bitcoin.

If you are looking for Internet e-commerce attorney jobs, click here for the very best.